Introduction:

Although the EUR-CHF pair is not one of the most traded currency pairs in forex, it remains a very popular trading instrument, especially with investors interested in the short term. In this article, we will therefore review the EUR/CHF pair and its price. We will see how to trade Euro France Switzerland. via the best forex brokers in France.

Step 1: Registration with eToro

The first step you will need to take will be to complete the basic registration form. In particular, you will be asked to enter your surname, first name, telephone number, and email address. You will also need to choose a username and password. This data will be used later for the connection to the eToro platform.

Once you have completed all the fields in the form, you will need to agree to the Terms and Conditions and Privacy Policy. To do this, simply tick the corresponding boxes. Finish by validating the form by clicking on the “create an account” button.

Once you have completed all the fields in the form, you will need to agree to the Terms and Conditions and Privacy Policy. To do this, simply tick the corresponding boxes. Finish by validating the form by clicking on the “create an account” button.

Step 2: Verify your Account

For this 2nd step, you will have to verify your forex account. To do this, you will need to start by clicking on the “complete profile” button. You will first be asked for your physical address. Note that you will then have to provide proof of address which must include this address. The 2nd step of account verification will concern the “know your customer” process.

This questionnaire contains a whole series of questions about your financial knowledge, your income and financial situation, and your experience of the markets. It is important to note that this is a regulatory obligation for all brokers regulated in the European Union. This is to ensure that their clients fully understand the risks of the financial products they are trading and in particular the EUR-CHF pair.

Step 3: Fund your Forex Account

Once you have validated and verified your account, you will be able to deposit money into it. So you can start real EUR/CHF trading. Start this process by clicking on the “deposit money” button at the top left of the eToro interface .

You w of denomination. You will also have to fill in the information relating to the means of payment used, to validate the transaction.

Step 4: Display EUR CHF Price Chart

To discover all 52 currency pairs available on the eToro trading interface, you must first click on “markets” in the left column. On the next screen, you will then need to click on “Forex” in the menu at the top of the screen. The list of 52 currency pairs that you can trade with the eToro broker will then be displayed.

Note that this list has interesting details such as a mini chart or market sentiment data for each currency pair. Thus, it is possible to identify at a glance opportunities to study further.

But it is also possible to find the EUR/CHF pair more directly. To do this, you just need to type its name in the search engine at the top of the trading platform.

You will then need to click on the “invest” button which will appear opposite the name of the EUR/CHF pair. This will allow you to open the order window that we will describe in the next step.

You will then need to click on the “invest” button which will appear opposite the name of the EUR/CHF pair. This will allow you to open the order window that we will describe in the next step.

Step 5: Trade EUR CHF with Live Quotes

On this EUR/CHF order window, several very important parameters must be entered.

You will find below the list of these parameters as well as their explanation.

You will find below the list of these parameters as well as their explanation.

- Order type: Immediate or scheduled

- Amount to devote to the EUR CHF position

- Leverage to apply to this EUR CHF trade

- Stop-Loss, the protection threshold in case of loss

- Take-Profit, the profit target

Once you have configured and verified each of these details, you will need to click on the “open position” button. Immediately, the order will be transmitted to the market. In the case of an immediate execution order, it will be immediately possible to follow its evolution as well as the latent gains and losses on the eToro interface

The Best Brokers Trading EUR/CHF

Now let’s go through all the details of each of these brokers in the section below.

Toro: Trading EUR CHF 0% Commission With Ideal Platform for Beginners

The name of the online broker eToro is clearly the one that comes up most often when asking novice traders about their favorite broker, especially when it comes to trading the EUR-CHF pair.

If it is so widely appreciated, it is in particular because it offers a platform that is particularly easy to learn, but also offers all the essential functions for experienced traders.

Regarding security and reliability, it should be noted that eToro is an online broker regulated by two different organizations. Moreover, having been created in 2007, it is also a broker with a long history, which is a pledge of confidence.

Beyond a particularly ergonomic trading platform, eToro also displays other key strengths.

Trading EUR CHF with eToro

What makes it stand out the most from other online brokers is probably its social trading features. Indeed, eToro is the world leader in this field. This broker’s platform allows you to identify the best traders, then automatically copy their positions to your own trading account.

What makes it stand out the most from other online brokers is probably its social trading features. Indeed, eToro is the world leader in this field. This broker’s platform allows you to identify the best traders, then automatically copy their positions to your own trading account.

Regarding the diversity of currency pairs available on the platform, it should be noted that the broker offers a total of around fifty pairs in addition to the EUR CHF pair. Of course, it is also possible to invest in several other markets, including the stock market, ETFs, commodities such as gold and oil, and even cryptocurrencies.

It should also be noted that the broker eToro charges some of the lowest fees on the market. No commission is charged on the purchase or sale of the EUR CHF pair. The broker is content to practice a slight difference between the purchase price and the sale price of the currency pairs. Finally, it should be noted that the maximum leverage offered by eToro is 30, in accordance with European regulations.

AvaTrade: Online Broker for EUR CHF Trading with MT4

The AvaTrade broker is also a leading broker. As is the case with the other brokers on this list, this is a broker with a long track record. It was indeed founded in 2009.

It should also be noted that it is a broker that is regulated by several authorities, thus confirming its reliability. No less than 6 regulatory bodies oversee the activities of this broker.

Trading EUR CHF With AvaTrade

About the EUR CHF trading conditions, it should be noted that the AvaTrade broker offers the MT4 and MT5 platforms. It is therefore one of the rare brokers that has not developed its own platform. But we must not forget that the MT4 and MT5 platforms are the most widespread platforms in the world. Despite an austere design, they indeed offer advanced features, especially with regard to automated trading.

The range of markets available at the AvaTrade broker is also very wide. In addition to dozens of Forex currency pairs, including the EUR CHF pair, you will also have the opportunity to invest in other markets such as commodities or indices.

The range of markets available at the AvaTrade broker is also very wide. In addition to dozens of Forex currency pairs, including the EUR CHF pair, you will also have the opportunity to invest in other markets such as commodities or indices.

It should also be noted that the broker is one of the brokers that offers complete trading training to all their new clients. Finally, it should be noted that allowed is otherwise a maximum of 30.

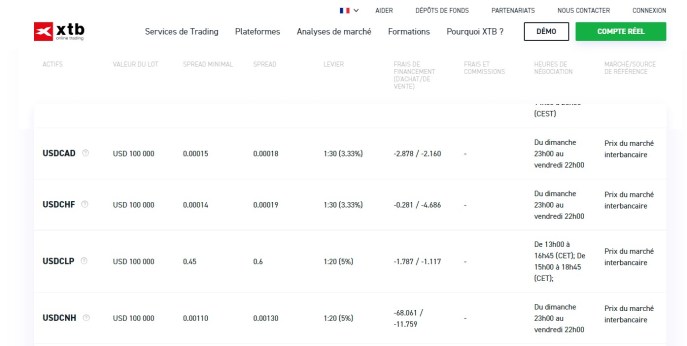

XTB: Negotiate EUR CHF with a Broker Installed in France

Third in this list but not least, XTB is also a broker that displays great qualities.

Third in this list but not least, XTB is also a broker that displays great qualities.

It is first of all a broker with a long experience, since it was founded in 2002. It is of course also a regulated broker in the European Union, otherwise, it would not be part of this list.

But what makes XTB stand out the most from other Forex brokers is the fact that it has a physical office in France. It is indeed an undeniable guarantee of reliability.

Trading EUR CHF At XTB

In addition, it is possible to access many Forex currency pairs in addition to the EUR CHF on this platform. Other markets are of course accessible, such as indices, commodities, or even ETFs.

About the EUR CHF trading conditions, it should be noted that the broker XTB offers its own trading platform, which takes the name of Xstation 5. In addition to the currency market, you will also be able to trade a wide range of financial products. It should be noted that the broker offers a total of more than 4000 titles.

Let’s finish by specifying that the spread practiced on the EUR CHF pair by the broker XTB is very low, while the maximum authorized leverage is 30, in accordance with the regulations currently in force in Europe.

Libertex: Very Experienced Online Broker For EUR CHF Trading

This top online broker displays several key advantages. Regarding the most important criterion, namely security, it should be noted that Liberté is a broker that was founded in 1997. As such, it is one of the oldest online brokers on the market. Obviously, it is also a regulated broker in the European Union.

This top online broker displays several key advantages. Regarding the most important criterion, namely security, it should be noted that Liberté is a broker that was founded in 1997. As such, it is one of the oldest online brokers on the market. Obviously, it is also a regulated broker in the European Union.

About the broker itself The second is the famous Metatrader 4.

In more detail, we note that WebTrader can be used from any internet browser. It is an easy-to-learn and fast-paced platform. For its part, Metatrader 4 is when it is the favorite platform for traders keen on Forex robots.

EUR CHF Trading Explained

In this section, we will first explain what the EUR-CHF pair is, followed by explaining what EUR-CHF trading is all about. We will also list everything you will need to start trading EUR CHF.

What is the EUR CHF?

Although not a major, this pair is relatively popular, especially among swing traders. volatility without compromising liquidity.

Although not a major, this pair is relatively popular, especially among swing traders. volatility without compromising liquidity.

Due s more volatile in the short term.

Economically, the Euro Zone eclipses Switzerland, with a GDP of $19.7T recorded in 2017, compared to only $679B for the same period in the Alpine country. However, the larger economy for stability and fiscal responsibility. This is why Europeans often turn to Switzerland to store their heritage.

While the Eurozone is a broad-based economy, Switzerland is heavily dependent on its financial industry and exports (with tourism coming next). This is the similarity between trading USDCHF and EURCHF.

What is EUR CHF Trading?

Concretely, EUR CHF trading consists in trying to profit from the variations of the euro against the Swiss franc on the foreign exchange market. Most of the time, EUR CHF traders base their trading decisions on the charts. If they think the pair will go up, they should buy. If they are right, they make a profit. If the EUR/CHF pair falls, they will take a loss. Conversely, if a trader thinks the EUR-CHF pair will fall, he should sell it. If it does fall, he makes a profit. If on the contrary, it progresses, he will lose money.

It is possible to decide whether to buy or sell EUR CHF with various methods. The 2 main ones are technical analysis and fundamental analysis, disciplines that we will cover in more detail later in this guide.

EUR CHF traders can on the other hand be very active, taking many trades every day, or on the contrary make fewer trades, but on a longer term. This all depends on the chosen EUR CHF trading style, a topic we will cover in the next section.

Which Strategies for Trading EUR CHF?

Depending on the time horizon over which one invests in the EUR CHF pair, there are different trading styles. We will therefore detail the 3 main EUR CHF trading styles in the section below.

Scalping EUR CHF

EUR CHF scalping is a very active and very short term trading style. Indeed, the principle of EUR CHF scalping is to carry out a large number of operations each day, each time aiming for minimal gains. Thus the accumulation of small gains during the day gives rise at the end of the trading session to very interesting profits. It is therefore not uncommon for EUR CHF scalpers to carry out several dozen transactions per day.

Because of this, EUR CHF scalpers use very short-term charts . Basically one minute and 5 minute chartstrend does not matter. Indeed, EUR CHF scalpers are mainly looking to take advantage of micro-movements that have little to do with the general direction of the pair’s movement.

EUR CHF scalping also requires making decisions very quickly. This limits the possibilities of analysis and use of indicators. Thus, to reach their trading decisions, EUR CHF scalpers primarily use techniques that are simple and quick to apply. It beginners.

In addition, you must be aware of the fact that this is a trading style that requires a very high availability in terms of time. Indeed, EUR CHF scalping requires constantly staying in front of your trading platform during the trading day.

EUR CHF Scalping Features

- Typical target gain per trade: 5 to 10 pips

- Graphics used: 1 minute / 5 minutes

- Use of simple analysis techniques, such as support, resistance, trend lines, and channels

- From 10 to 100 EUR CHF trades per day

- Requires high availability

EUR CHF Day Trading

EUR CHF day trading is also a short-term trading style, but less active than scalping. However, day traders still generally open several trades per day. With day trading, the goal is to open positions early in the day and have them all closed by the end of the trading session.

To make their trading decisions, EUR CHF day traders rely on 15-minute and 1-hour charts generally. On such time scales, the general trend can therefore be taken into account. Thus, the first thing a EUR CHF day trader does at the start of the day will be to analyze the trend. Then it will look for an opportunity to move in the direction of the trend.

Unlike scalping, EUR CHF day trading allows time for proper analysis. It will therefore be possible when making a decision to involve elements of graphic analysis, as well as forex indicators.

Finally, it should be noted that EUR CHF Day trading implies average availability. It is indeed possible to analyze the market and plan its positions in the morning, to then go about its business, leaving stops and limits to act automatically.

EUR CHF Swing Trading

Swing trading is the least active EUR/CHF trading style. Indeed, EUR CHF swing trading aims to benefit from broad trends over several days. Thus, a EUR CHF swing trader may only take a few trades each month.

The most common chart time units used by EUR CHF swing traders are the 4-hour and 1-day charts. On such time horizons, it is possible to carry out advanced technical analyzes taking into account the graphic trend as well as several indicators. But it is also a long enough time horizon for fundamental factors to influence the trade. They account

Finally, note that EUR CHF swing trading is an ideal trading style for people who do not have a lot of time to devote to trading, but who still want to start profiting from it.

Features of EUR CHF Swing Trading

- Typical target gain per trade: 50 to 200 pips

- Graphics used: 4 hours / 1 day

- Use of trend analysis techniques, such as supports, resistances, trend lines and channels, and technical indicators such as MACD or RSI. Consideration of fundamental factors.

- From 5 to 10 EUR CHF trades per month

- Possible with very limited availability

How to Do a Euro–Swiss Franc Analysis

There are 2 main methods for analyzing forex currency pairs and more specifically the EUR-CHF pair. These are technical analysis and fundamental analysis. In this section, we will therefore provide you with more details on these 2 analysis methods. We show you the steps to follow to acquire the knowledge you need.

EUR CHF Technical Analysis

The basic principle of technical analysis is to study the past to predict the future. Specifically, technical analysis looks at past price action via charts to arrive at trading decisions. Concretely, the EUR/CHF technical analysis aims to answer 3 essential questions.

- The first concerns the trend. Is it bullish or is it bearish?

- The second question concerns timing. When exactly should you position yourself?

- Finally, the third question concerns exit from positions. When should a gain or closed?

In the following sections, we will provide you with the first indications that will allow you to answer these questions.

1 – Analyze the EUR/CHF Trend

Analysis of the EUR CHF trend can lead to 3 different conclusions: Uptrend, Downtrend, or Neutral Trend. To reach called chart analysis. This is an essentially visual discipline that consists of identifying important levels and particular configurations on the charts.

Among the technical methods which make it possible to evaluate the tendency, one can in particular point out tools such as the supports, the resistances, the lines of tendency, the channels of tendency, or the graphic triangles.

To get trading signals, EUR CHF traders use forex indicators. These include the RSI, the Macd, the stochastic, or even the ADX. Each indicator responds to interpretation principles that may differ. However, one can master the interpretation of an indicator in a few minutes. Concretely, these indicators will allow us to obtain buy and sell signals that tell us exactly when and at what price to position ourselves.

Determine your objectives on EUR CHF

Finally, the last objective of technical analysis is to manage position exits. More concretely, it will be a question of knowing at what level to position its stop and its limit. To do this, you will first need to identify important thresholds on your chart.

You will be able to spot these important thresholds through techniques such as supports and resistances, Fibonacci retracements, pivot points, or others. After having identified these important thresholds, you will have to choose among them a stop and a limit. Attention, it is necessary to keep in mind a basic principle of risk management, which stipulates that the stop must be tighter than the limit. In other words, the risk of loss must be less than the potential for gain.

EURCHF Fundamental Analysis

The fundamental analysis of the EUR CHF pair looks at all the economic, macroeconomic, geopolitical, or other factors that can influence the price of the EUR CHF pair. Regarding the technical analysis, there are 2 important details to highlight. The first is that fundamental analysis is more complicated to learn than technical analysis. Indeed, technical analysis does not require any prior knowledge, while fundamental analysis requires a good understanding of the economy. But above all, the fundamental analysis only very rarely gives rise to concrete trading decisions.

Rather, the usefulness of fundamental analysis lies in its ability to gauge market sentiment. Are traders optimistic or pessimistic? The answer to this question can tell which currency pairs are more likely to rise than fall. But fundamental analysis also lets you know in advance when market volatility is likely to spike . Indeed, we know in advance the date and time of publication of each potentially influential statistic thanks to the economic calendar.

EUR CHF Benchmark Analysis

Another very important point to understand in the fundamental analysis of the EUR-CHF pair is that it is really a comparative analysis between the Eurozone and Switzerland. Indeed, the EUR-CHF pair can rise against a rise in the euro, against a fall in the Swiss franc, or both. Conversely, the EUR-CHF pair can fall against a fall in the euro, against a rise in the Swiss franc, or both.

Thus, the fundament of Europe and that of Switzerland. The basic idea is to know which of the 2 economies is the strongest. Of course, the currency of the country with the strongest economy should rise.

However, to study the respective he in 2 subjects in priority. These are central bank monetary policy and influential economic indicators. As far as central bank po, the European Central Bank, and the SNB, the Swiss national bank. With regard to economic indicators, we will focus primarily on statistics for the eurozone and statistics for Switzerland. Note calendars.

Is it Interesting to Trade the Euro Swiss Franc?

The main reason one usually wants to get into EUR/CHF trading is to make money. However, there are several things you need to be aware of in order to realize the reality of trading. This is what we will cover in this section.

1 – Big Potential Gains at Key

Trading on the EUR CHF pair and on forex, in general, is a particularly speculative style of trading. Indeed, forex is known as a market where daily volatility is high. In addition, forex brokers allow trading the EUR-CHF pair with high leverage. Therefore, forex is known as the greatest gain.

Trading on the EUR CHF pair and on forex, in general, is a particularly speculative style of trading. Indeed, forex is known as a market where daily volatility is high. In addition, forex brokers allow trading the EUR-CHF pair with high leverage. Therefore, forex is known as the greatest gain.

However, it should never be forgotten that with the potential for a large gain, there is always an equally large risk of loss. So, although the EUR-CHF pair is an opportunity to make big gains quickly, it also involves the risk of losing money very quickly. However, with strict risk management rules, it is possible to limit and control this risk.

2 – Is it Possible to Make a Living from EUR CHF Trading?

If you can make money trading EUR/CHF, why not try to make a living from it? This is indeed the ultimate goal of many traders who start forex. However, we must immediately understand that there is a gap between managing to earn money with trading and managing to earn enough money sufficiently regularly to be able to live from trading.

If you can make money trading EUR/CHF, why not try to make a living from it? This is indeed the ultimate goal of many traders who start forex. However, we must immediately understand that there is a gap between managing to earn money with trading and managing to earn enough money sufficiently regularly to be able to live from trading.

Before you can consider making a living from trading EUR CHF, you will need to ensure that you are capable of making substantial and regular gains. However, we must immediately realize that this does not happen overnight.

You will first need to take the time to train yourself in trading. Next, you will need to develop and refine a viable demo trading strategy. Then you will have to start moving to real trading by gradually increasing the bet. It is then only after several months or even several years of regular earnings that you can consider giving up all professional activity to devote yourself full-time to EUR/CHF trading.

Conclusion:

EUR CHF trading is therefore an activity that can prove to be interesting for many investors. However, this will not suit long-term investors who wish to minimize risk-taking. On the contrary, trading is a rather term. Buth-suited.

If you too want to start profiting from EUR CHF trading, you will need to choose a forex broker. We’ve covered five of them in this guide. All of them can be high-quality services. However, we also noticed that there is one that stands out more than the others. This is the online broker eToro. It is indeed the broker that offers the most popular trading platform for beginners. But it is also the best broker when it comes to social trading. We, therefore, invite you to inquire about this leading intermediary now.