IN SUMMARY

- Micro Strategy’s massive Bitcoin investment, fueled by Michael Saylor’s belief in the future of BTC, has sparked debate over its impact on Bitcoin’s decentralization.

- Critics argue that Saylor’s buying spree and Bitcoin’s concentration could risk centralization, potentially challenging the cryptocurrency’s core tenets.

- Despite the concerns, Saylor’s conviction remains unshakable, leading to broader implications for the traditional financial system’s perception of cryptocurrencies.

- PROMOMeet the world’s first smart wallet AmazeWallet

The scale and implications of MicroStrategy’s recent Bitcoin (BTC) acquisitions have sparked vigorous debate in traditional financial and cryptocurrency circles.

The main question is: is Bitcoin becoming centralized due to these massive purchases?

MicroStrategy is betting more on Bitcoin

MicroStrategy, the enterprise software company led by Michael Saylor, has since August 2020 adopted an unorthodox balance sheet strategy. Replaced traditional cash reserves with Bitcoin.

Its recent purchase of 12,333 BTC, at an average price of $28,136 per coin, reaffirms the company’s bullish stance on cryptocurrency. The company’s Bitcoin vault now totals a staggering 152,333 BTC, purchased at an average price of $29,668.

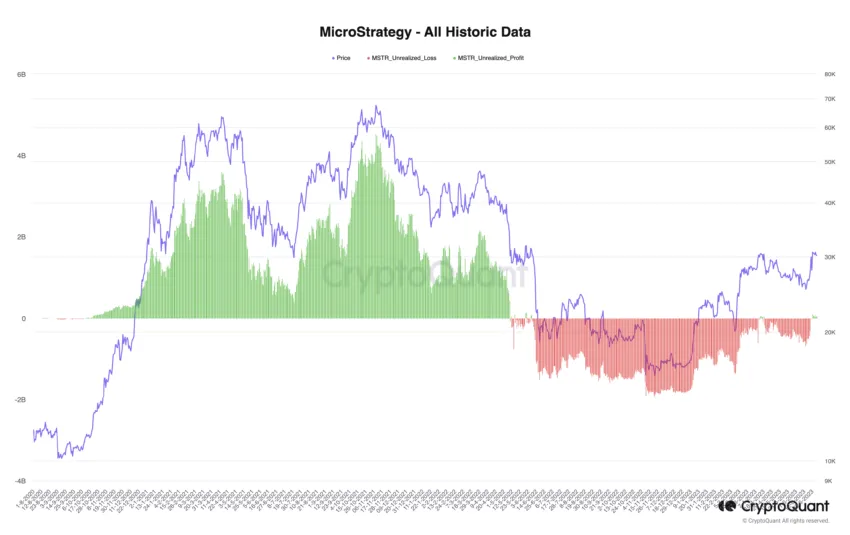

MicroStrategy Bitcoin purchase history. Source: CryptoQuant

MicroStrategy Bitcoin purchase history. Source: CryptoQuantThis intense Bitcoin buying spree has positioned MicroStrategy as one of the largest institutional holders of Bitcoin in the world.

Saylor’s Bitcoin balance now represents approximately 0.81% of the available Bitcoin supply. This assumes that around 3.7 million BTC is unrecoverable, according to a Chainalysis study.

Where Bitcoin is stored. Source: Chainalysis

Where Bitcoin is stored. Source: ChainalysisThis level of concentration raises questions about the potential centralization of a currency valued for its decentralized nature.

Michael Saylor’s Impact on the Price of Bitcoin

MicroStrategy’s Bitcoin investment strategy, conceived as a defense against inflation and currency debasement, appears to revolve around an “energy currency” paradigm.

This concept, originally proposed by the American industrial titan Henry Ford in 1921, involves backing the currency with “units of power”, creating a new monetary standard. Ford’s vision was of a monetary standard resistant to control by any “international banking group”.

This aspiration resonates with Bitcoin’s philosophy, which is why Saylor remains optimistic about Bitcoin’s long-term value proposition.

Value of MicroStrategy Bitcoin Holdings. Source: CryptoQuant

Value of MicroStrategy Bitcoin Holdings. Source: CryptoQuantThe question, however, is whether Saylor’s unwavering conviction and Bitcoin’s substantial accumulation potentially alter the cryptocurrency’s intrinsic decentralized nature. Especially when recent announcements have proven to affect the price of Bitcoin.

“MicroStrategy BTC buy announcements tend to be followed by negative BTC price action in the near term as the market absorbs the fact that some buy-side liquidity has left the market,” said Vetle Lunde , research analyst at K33.

Bitcoin price action related to MicroStrategy purchases. Source: K33 Survey

Bitcoin price action related to MicroStrategy purchases. Source: K33 SurveyIndeed, the confluence of Saylor’s relentless buying and his relentless advocacy of Bitcoin influences market dynamics. The sheer scale of MicroStrategy’s holdings could have even more severe implications for Bitcoin’s price if the company fails to weather the volatile nature of this cryptocurrency.

“[MicroStrategy] is valued almost entirely as a Bitcoin holding company. So if for some reason, like a liquidity crunch during a recession, the price of Bitcoin were to drop too much, the company would end up being valued at nothing… If [MicroStrategy] goes bankrupt, Bitcoin assets will be liquidated. This could have a big impact on the price of Bitcoin,” said a prominent member of the crypto community.

Furthermore, some argue that such accumulation of Bitcoin in a few hands contradicts its original design as a decentralized and democratized digital asset. Critics question whether the risks of centralization outweigh the potential benefits of Bitcoin’s “energy currency” paradigm.

Popular cryptocurrency enthusiast Hodlnaut warns that after the next halving, MicroStrategy’s Bitcoin holdings will be equivalent to the total block subsidies accumulated over an entire year.

But for all those who believe the company is becoming a “very big” BTC holder, CoinMotion co-founder Henry Brade suggests :

“Stop selling your Bitcoin to them. It is the most valuable asset the world has ever seen. Treat him accordingly.”

A growing trend: BTC as a hedge

Michael Saylor’s vision of Bitcoin as an effective hedge against inflation is gaining more and more acceptance. MicroStrategy’s Bitcoin buying spree represents a bold shift in traditional companies’ approach to cryptocurrencies, a move that some see as pioneering and others as impulsive.

Ultimately, the impact of Saylor’s massive Bitcoin buying spree on potential Bitcoin centralization remains a controversial topic.

While there are concerns, Bitcoin’s decentralized infrastructure remains intact. A company’s significant stakes do not change the underlying protocol that ensures Bitcoin’s decentralization.

While Saylor and MicroStrategy now own an undeniably large share of the cryptocurrency, Bitcoin remains fundamentally decentralized.

However, as more companies potentially follow MicroStrategy’s lead, the discourse around Bitcoin centralization will likely remain an important and evolving conversation in the cryptocurrency market.

This dialogue can be critical in shaping regulatory norms, public perception, and the future trajectory of Bitcoin.