Introduction:

Often, the EUR USD price is the first contact one has with the forex world, especially when it comes to online trading. The EUR/USD pair is indeed by far the most popular currency pair in forex. This guide tells you everything about the Euro Dollar price and explains in detail what EUR USD trading is, how to analyze the Euro Dollar, what strategies to adopt, and how to succeed in trading the Euro USD price.

Libertex: Trade the Euro Dollar Without Spreads

Libertex is also a leading online broker, which has won millions of customers around the world, thanks to its many advantages.

These include a very old online broker, established in 1997. This is a sure sign of reliability. The safety of this broker is also confirmed by the fact that it is regulated. It is also regulated by Cysec Cyprus. The last sign that testifies to the seriousness of this broker is the opinion of its customers, which is mostly positive if we are to believe the specialized forums.

First of all, we note that the broker is far from being limited to EUR/USD trading. You can indeed make daily transactions on all markets with this online broker. This includes stocks, through CFDs, the forex market, and many commodities including gold and oil, or ETFs.

Euro USD Trading at Libertex:

As for the platform on which you will practice EUR/USD trading at Libertex, know that the broker allows you to choose between two different interfaces. These are WebTrader, their internal platform, and the famous MetaTrader4. The web trader platform works with all web browsers. It is ergonomic, easy to use, and has a pleasant interface.

MT4 is the platform of choice for EUR/USD traders who want to trade automatically with forex robots. MT4 is a very good forex platform, which lends itself very well to all EUR/USD trading styles. However, it has a more austere design and less intuitive navigation. Libertex is therefore also an MT4 broker.

Finally, the last feature of Libertex that we want to highlight is EUR/USD spread-free trading. In fact, all currency pairs have a spread of 0 pips at this broker. Instead, it charges a small commission for each transaction.

Finally, by European legislation, the leverage effect offered for trading EUR/USD is 30. It can however be increased by validating a professional account.

XTB: Trade EURUSD on a reliable platform

A recognized and listed trading platform, XTB is one of the best for trading EUR/USD. Today, XTB has over 5400 financial assets available to its users. Thanks to this highly diversified catalog, XTB can claim to be one of the best operators on the market.

A recognized and listed trading platform, XTB is one of the best for trading EUR/USD. Today, XTB has over 5400 financial assets available to its users. Thanks to this highly diversified catalog, XTB can claim to be one of the best operators on the market.

XTB offers a secure platform regulated by many market regulators such as CySEC, FCA, KNF and IFSC. With quality services, interesting features and advanced trading tools, XTB is an ideal platform for investing in the EUR/USD price.

Trading EUR/USD on XTB:

The XTB platform offers you the best possible conditions for trading EUR/USD. Indeed, XTB offers you to follow in real time the latest market quotations as well as the sentiment of investors on the evolution of the price of the currency pair. Thanks to very precise analyzes and advanced tools available, you will have no trouble determining whether the investment is indeed profitable or not.

With an easy-to-use platform and an interface suitable for both beginners and experts, investors will be able to navigate without any difficulty.

If you are wondering about the spread, know that XTB applies quite competitive fees compared to its competitors in the market. It does not charge any commission for EUR/USD trading.

How to View the Euro Dollar Chart Price in Real Time and Invest?

Find below the detailed procedure to open an eToro account and how to trade the Euro Dollar on the forex as soon as possible.

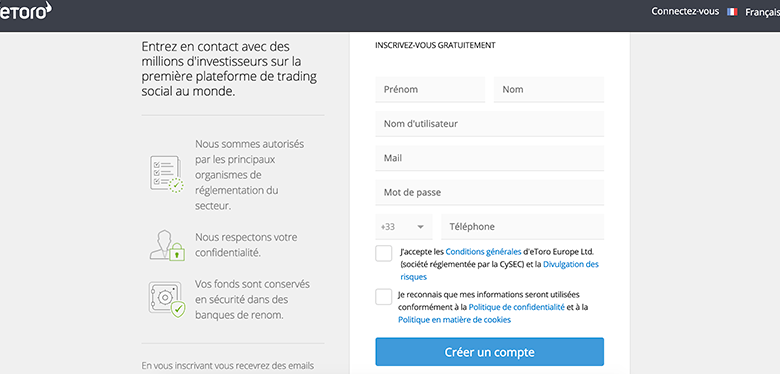

Step 1: Registration with eToro

This first step is to fill out the registration form with some basic personal information. These are your first and last name, your telephone number, and your e-mail address. You will also need to choose a password that you will use to log in to the eToro forex platform.

After completing the form, you will be asked to accept the terms and conditions and the privacy policy by checking the boxes provided.

After completing the form, you will be asked to accept the terms and conditions and the privacy policy by checking the boxes provided.

Validate the sending of the form by clicking on “Create an account”.

Step 5: Trade EUR USD with Live Quotes

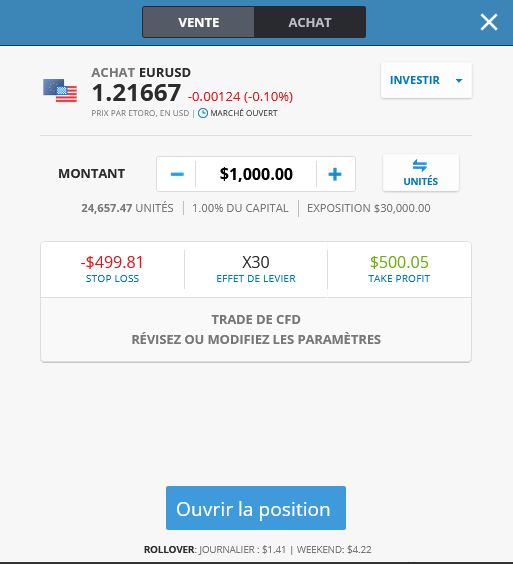

When you have completed your analysis of the EUR-USD pair and are ready to make a trading decision, you will need to click on “A” for buy or “V” for sell at the top of the window depending on the desired direction for the EUR/USD position.

On this window, you will need to enter several parameters, then validate the trading order. For example, you will have to choose:

On this window, you will need to enter several parameters, then validate the trading order. For example, you will have to choose:

- Order type : Immediate or scheduled

- Amount to devote to the EUR USD position

- Leverage to apply to this EUR-USD trade

- Stop Loss , the protection threshold in case of loss

- Take Profit, the gain target

To send the order to the Forex platform, click on Open position. It will then be immediately possible to follow the progress of your transaction in real time from the eToro EUR USD trading platform.

What Impacts the EUR-USD Price on Forex?

What are the factors that can influence the price of the Euro Dollar? By what mechanisms can the EUR/USD rise or, on the contrary, fall? Let’s summarize the main influences that govern the EUR/USD price below.

Economic Calendar:

As we have already mentioned earlier in this guide, certain statistics can considerably influence the price of the EUR/USD pair. All economic statistics, for all currency pairs, are referenced in the economic calendars. Economic calendars are available free of charge from brokers or on financial websites, and let you know what statistics are expected each day, and at what precise time, also providing you with consensus forecasts. So, checking the economic calendar and spotting the day’s potentially influential Euro Dollar statistics should be a EUR/USD trader’s first task every day.

Central Bank Policy:

We also mentioned the influence of the Fed and the ECB on the price of the EUR/USD, in particular via the setting of key rates. It is therefore important for any forex trader to pay close attention to each central bank meeting , to learn about decisions, and to assess what may be decided in the future. Likewise, outside of central bank meetings, it will be necessary to monitor all the speeches by members of the Fed and the ECB, which often contain indications of what the central banks could decide in the future, and which can therefore considerably influence the price of the EUR/USD pair.

We also mentioned the influence of the Fed and the ECB on the price of the EUR/USD, in particular via the setting of key rates. It is therefore important for any forex trader to pay close attention to each central bank meeting , to learn about decisions, and to assess what may be decided in the future. Likewise, outside of central bank meetings, it will be necessary to monitor all the speeches by members of the Fed and the ECB, which often contain indications of what the central banks could decide in the future, and which can therefore considerably influence the price of the EUR/USD pair.

Market Sentiment:

The Euro is seen as an asset favored by risk appetite. Conversely, the Dollar is considered a haven and is, therefore, a sought-after asset when investors get scared. Apart from considerations relating to economic statistics and central bank policy, overall positive market sentiment will benefit the Euro more than the Dollar. On the contrary, periods of doubt and panic in the financial markets will sometimes tend to support the Dollar.

Technical analysis:

Technical analysis is used by all traders. Thus, the most important signals tend to have self-fulfilling power. Indeed, if thousands of traders see the same buy signal on EUR/USD at the same time and act accordingly, the value of the Euro Dollar will progress mechanically by an increase in buy orders. So even if you’re not a fan of technical analysis, it’s still interesting to watch the most important trend lines, or major moving averages such as the 50, 100, and 200 periods, especially on daily charts.

Comparative analysis:

Finally, you should never lose sight of the fact that a currency pair is made up of two assets. Thus, it is almost always a comparative analysis that one must carry out to predict the evolution of the EUR/USD. For example, if the European statistics are disappointing, but the US statistics are even worse, the EUR/USD pair could go up. Similarly, if the BE raises rates, but the Fed raises them further, the EUR/USD pair will fall despite the ECB raising rates.

EUR USD Trading Explained:

As you will surely have understood, EUR-USD trading consists of trading on the Euro Dollar pair. Before going into more detail about the trading strategies of the EUR-USD pair, we will therefore come back to what the Euro is, and what the Dollar is.

As you will surely have understood, EUR-USD trading consists of trading on the Euro Dollar pair. Before going into more detail about the trading strategies of the EUR-USD pair, we will therefore come back to what the Euro is, and what the Dollar is.

According to the Bank for International Settlements (BIS), which compiles statistics in cooperation with global central banks to feed global liquidity analysis, the US dollar and the euro are, among others, the two most traded currencies in the world. And EUR/USD is the most traded pair.

The first thing to understand when approaching EUR/USD trading is that you must simultaneously analyze the Dollar and the Euro. In effect :

- The EUR/USD pair can go up either because the euro is strengthening, because the dollar is falling, or both.

- The EUR/USD pair can fall either because the euro is falling, because the dollar is strengthening, or both.

- A EUR USD purchase, therefore, amounts to betting on the rise of the Euro and/or on the fall of the Dollar.

- A EUR USD sale, therefore, amounts to betting on the fall of the Euro and/or the rise of the Dollar.

When to Trade the EUR/USD Price?

The most active time for the EUR/USD pair is when the London and New York sessions are underway. Both markets are open simultaneously between 8:00 GMT and 22:00 GMT, Monday through Friday. However, it is between 07:00 GMT and 20:00 GMT that the EUR/USD pair experiences the greatest price movement according to historical studies of the volatility of this currency pair.

Then the move starts to fade unless there is a major economic release or monetary policy statement. These announcements could cause price volatility.

What is the Best Way to Trade EUR USD?

Many traders choose to trade the EUR-USD currency pair via CFDs, as it offers more trading opportunities. Indeed, you can trade both bull and bear markets, choosing to go long or short on the contract. Also, you don’t have to own the currencies to be able to trade them, which means you can trade with significantly less capital. You will therefore have to turn to a CFD Broker to open an account.

Whether you choose a proven strategy or develop one yourself, ensure that all trading decisions you make are based on sound technical and fundamental analysis. And always keep an eye on published data and geopolitical developments, as they impact currency prices. Most importantly, remember to have strong risk management measures in place before entering into a trade.

What Are the Most Effective EUR USD Trading Strategies?

The key to long-term trading success is to have a solid strategy and stick to it, regardless of temptation or fear. Trading the EUR/USD pair is no different. Traders have found that three strategies tend to work well for the most liquid currency pair in the world.

Trading Pullbacks:

The EUR/USD pair, like any other currency pair, follows both up and down trends, which generates multiple trading opportunities. The problem is that these price movements are quite fast, and under the influence of the law of supply and demand, the momentum of price movements can also run out of steam or suddenly move in the opposite direction.

So, the pullback strategy focuses on these counter-trend moves, identifying support and resistance levels when the price trend moves back in the original direction. These levels often return to previous highs or lows, while returning to key levels identified by Fibonacci retracements and moving averages.

Trading Breakouts and Breakouts:

The EUR/USD pair tends to rise and fall within a confined range for extended periods, which generates well-defined trading ranges. These trading ranges eventually lead to new trends. It is important to remain patient during periods of consolidation, as you may be able to identify low-risk entry points when support or resistance levels eventually give way, causing either a sharp rise or fall.

Timing is the key to getting the most out of this strategy, where traders choose to buy the breakouts and sell the breakouts. Entering too early can be risky, as the range can last and trigger a reversal. On the other hand, a late entry means that you run the risk that your trade will be executed significantly above the new support level or significantly below the new resistance level. Traders sometimes attempt to reduce this risk by entering partial positions when the currency pair breaks out or breaks down, then completing their position at the first minor retracement.

EUR USD Trading Strategies:

In this section, we will introduce you to the 3 main EUR USD trading styles that exist, namely scalping trading, day trading and swing trading.

Scalping EURUSD:

Forex Scalping is a very short-term trading style. The principle is to take many positions every day, sometimes dozens, each time aiming for a minimal gain, of only a few pips. With scalping trading, positions are only held for a few seconds. In addition, 1-minute and 5-minute charts are generally used for scalping. It is therefore a style of trading in which you have to stay constantly in front of your screens, and in which you have to make decisions quickly. Thus, scalpers generally use very simple principles of technical and chart analysis, not having the time to do an in-depth analysis for each position taken.

Find below an example of a forex scalping trading strategy on EUR/USD:

- 1-minute chart

- Buy on an uptrend line

- Sell on the downtrend line

- 10 pip target

- Stop at 5 pips

Day Trading EURUSD:

Day-Trading Forex is a short-term trading style, which consists of opening positions at the beginning of the day to have them all closed by the end of the day. Positions are therefore generally held for a few hours. Most of the time, day traders use 15-minute charts and hourly charts. This is a trading style that requires less time: You can analyze the market and open positions in the morning, to let them follow their course and hit their stops and limits before taking stock at the end of the day. With this style of trading, we have more time to analyze the market.

Find below an example of a forex day trading strategy on the EUR/USD:

- 15 minute chart

- Buy on bullish RSI divergence or oversold signal

- Sell on bearish RSI divergence or overbought signal

- Target at 25 pips

- Stop at 10 pips

USD USD Swing Trading:

Swing trading is considered in forex as a medium-term trading style. Typically, forex swing trading positions are held for a few days. Swing traders base their trading decisions on daily and 4-hour charts, although they can also study the underlying trend on weekly charts. Like day trading, swing trading allows ample time to properly analyze the market, which can lead to more complex strategies from a technical analysis perspective.

Find below an example of a forex swing trading strategy on the EUR/USD:

- 4-hour chart

- Buy on bullish MACD crossover

- Sell on MACD bearish crossover

- 60 pip target

- Stop at 25 Pips

How to Analyze the Euro Dollar Price:

Whatever the financial asset being studied, there are always two main methods of possible analysis; These are technical analysis and fundamental analysis of forex. In this section, therefore, we will explain how to apply technical analysis and fundamental analysis to the EUR/USD currency pair.

Euro Dollar Technical Analysis:

The forex technical analysis of the EUR/USD pair answers 3 key questions. What is the direction of the trend, when should you buy or sell, and where should you place your stops and limits. In the paragraphs below, we will explain how to answer these questions.

EUR USD Trend Analysis:

Analyzing the trend can lead to 3 conclusions : Uptrend, Downtrend, and Neutral Trend. In bullish trends, we will primarily look for buying trading opportunities. In a downtrend, we will mainly look for selling opportunities. And in a neutral trend, we can invariably take a position to buy or sell depending on trading signals.

Analyzing the trend can lead to 3 conclusions : Uptrend, Downtrend, and Neutral Trend. In bullish trends, we will primarily look for buying trading opportunities. In a downtrend, we will mainly look for selling opportunities. And in a neutral trend, we can invariably take a position to buy or sell depending on trading signals.

To analyze the trend, forex traders mainly use graphical tools such as trend lines and channels. Moving averages can also be used, the direction and position of which in relation to prices also give valuable indications of the underlying trend.

Once you have determined whether the trend is bullish, bearish or neutral, you can move on to the next step, which is to find forex trading signals that will allow you to know exactly when to position yourself in the direction of the trend.

EUR USD Trading Signals:

For this second step, we will mainly involve forex indicators such as the RSI, the MACD, the CCI or the Stochastic. These indicators make it possible to identify what are called trading signals.The indicators are generally presented in the form of secondary graphs which are positioned below the graph of the evolution of the prices. All indicators are analyzed differently, but learning how to use them usually only takes a few minutes. Indeed, the main interpretations are simple and within everyone’s reach. It should be noted, however, that the indicators are not always right. Thus, many traders use two indicators simultaneously, and only take a position if the two indicators provide the same signal, or at least if they do not contradict each other.

Identifying Important EUR USD Thresholds

Finally, once you know precisely when to take a position, you must also plan the exit from the trade, that is to say the stop and the limit. For this, technical analysis offers many ways to identify “important thresholds”. These important thresholds are points of friction, blocking, or on the contrary potential acceleration of the market. These are therefore ideal levels to place stops and limits. To identify these important thresholds, traders use techniques such as support and resistance, Fibonacci retracements, or pivot points. Then, traders just have to choose their stop and limit from these levels, taking care to always choose a stop that is tighter than the limit.

Fundamental Analysis EURUSD Price:

The fundamental analysis of the EUR/USD pair focuses on the economic and political factors that influence the price of the Euro and the Dollar, and therefore that of the EUR/USD pair. We can identify two major influences: The monetary policy of central banks, and the statistics of the economic calendar. We detail all this below.

Central Banks Interest Rate Expectations:

Central banks have a particularly strong influence on the price of currency pairs. They control interest rates. The more a currency displays a high rate, the more “interesting” it is to hold, the more it pays. Thus, when studying a currency pair, one must be interested in the rate differential between the two currencies in the pair. In the case of the EUR/USD pair, it will therefore be necessary to compare the key rate of the Fed with that of the ECB, the advantage going to the currency which displays the highest rate.

However, in the end, more than the current rate, it is the expectations of the rate trajectory that will influence the currency pairs. Thus, we will be more interested in what the market expects the ECB or the Fed to do in the future, than in what they have decided recently. Central bank rate decision announcements are also times when the volatility of the EUR/USD pair can spike, especially on the Fed or the ECB making an unexpected decision.

Economic Statistics:

Economic statistics from the Eurozone, European countries and the United States can have a considerable influence on the EUR/USD pair. The principle is simple, if a European statistic is solid, it should benefit the Euro , and push up the EURUSD. The reverse is also true. The Dollar, for its part, should benefit from solid statistics, and be penalized by disappointing figures.

To know if an economic statistic should be considered good news, it is not enough to know if it has increased or progressed since the previous publication. In reality, this information is even of little importance. The most important thing is to know if a statistic is better or worse than what was predicted by the consensus. Consensus is the average of economists’ forecasts for a given statistic. This information is included in all economic calendars.

Let’s finish by listing the traditionally most influential economic indicators on the EUR/USD pair:

- NFP report on US job creations

- European PMI indices

- American ISM indices

- German Zew Business Climate Index

- GDP (European or American)

Trading EUR USD Example:

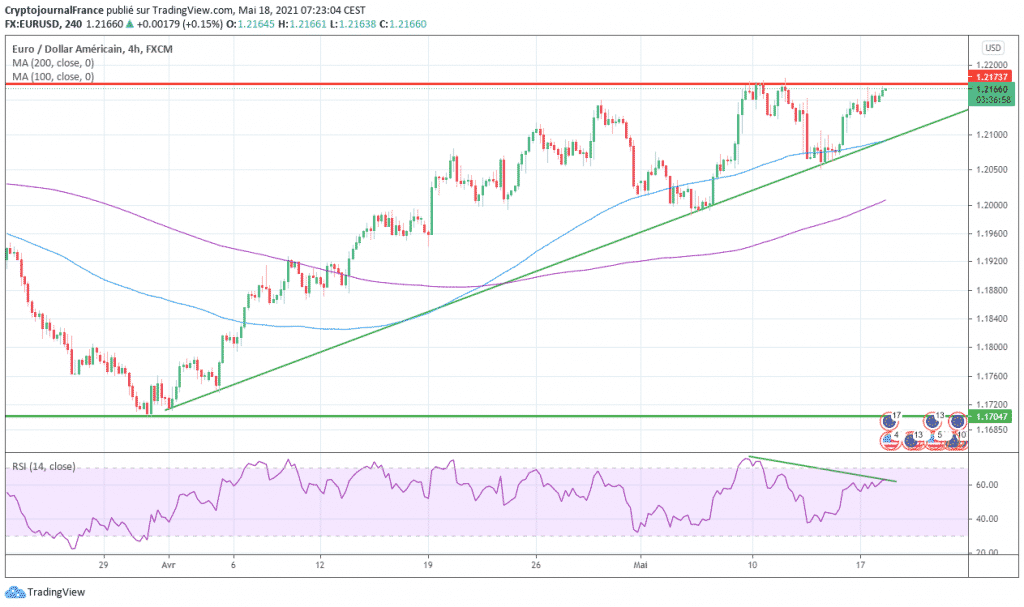

In this section, we will provide an example of EUR/USD trading. When faced with a 4-hour chart, we will make several technical observations and then deduce EUR/USD trading decisions. Let’s start by presenting the graph.

On this chart, we can spot an uptrend line that has been stretching since the middle of April 2021, and which is currently located around 1.21, which is an argument in favor of taking a long position.

However, we can also notice that lately, the EUR/USD is stuck on a resistance zone around 1.2170-80. On the contrary, this constitutes an index which should encourage to take a short position.

Another argument in favor of selling concerns a bearish divergence that can be spotted on the RSI technical indicator, and which constitutes a sell signal.

In the end, facing this EUR-USD chart, it is possible to make two valid trading decisions.

Sell EUR/USD:

- Sell around 1.2165

- Target at 1.2050 (trough of May 13)

- Stop at 1.2190

- Earning potential: 115 pips

- Risk of loss: 25 pips

Buy EUR/USD:

- Buy if back on the uptrend line, around 1.2120

- Target at 1.2250

- Stop at 1.2090, just below the psychological level of 1.20

- Earning potential: 130 pips

- Risk of loss: 30 pips

Who Can Trade Euro Dollar Price?

Although EUR/USD trading has many advantages, it must be said that it is not an activity that will suit everyone. In this section, you will therefore find the two key questions that you must ask yourself to know if EUR/USD trading is for you, as well as indications to be able to answer them.

Are you ready to Take Risks?

Although there are riskier markets than EUR/USD, it is not the least risky market. The volatility of the EUR/USD pair, and the possibility of practicing leverage trading, make forex trading a risky activity. But this is the price to pay to hope to post big gains. In trading as in other areas, you have to be ready to take risks to hope for a substantial gain. Thus, if you are not ready to take significant risks, it will probably be preferable to move towards activities other than EUR/USD trading, such as managing a long-term equity portfolio.

Are you interested in Long Term Trading or Investing?

The EUR/USD pair is not the most suitable instrument for investing in long-term forex. If your objective is to buy and hold for several months, or several years, shares on the stock market or ETF trackers will undoubtedly be more suitable vehicles. To be interested in the EUR/USD pair is therefore almost necessarily to be interested in trading. However, trading is a more demanding activity than long-term investing.

Practicing EUR/USD trading indeed requires training in technical analysis, daily monitoring of economic news, development, testing and improvement of trading strategies, and more. In addition, a trader sometimes takes several positions per day, or even many within the framework of styles such as scalping. Trading takes a lot longer and requires a lot more effort than long-term investing, in addition to being more risky. Before embarking on EUR/USD trading, you will therefore need to ensure that you can devote the necessary time to it, otherwise, you will have no chance of succeeding.

Is it Interesting to Trade the Euro Dollar Price?

The first reason people usually start forex trading is to want to make money, independently, and from home. In this section, we will therefore ask ourselves if this is possible. How much money can you make with EUR/USD forex trading? What does the lifestyle of someone who has managed to live from trading look like? The answers below.

The first reason people usually start forex trading is to want to make money, independently, and from home. In this section, we will therefore ask ourselves if this is possible. How much money can you make with EUR/USD forex trading? What does the lifestyle of someone who has managed to live from trading look like? The answers below.

Real Earning Potential:

It is possible to make a lot of money trading the EUR/USD pair, it is not a legend. But there is a universal financial principle, valid in all markets. The potential return increases with the risk. The more money it is possible to make on a financial instrument, the more it is possible to lose. There is no way around this rule: If you want to make a lot of money trading EUR/USD, you have to be prepared for the possibility of also losing a lot, if not all of your investment. If you are not ready to take this risk, there are other markets and other types of less risky investments that will suit you better, for example buying stocks.

The Possibility of Living from Trading:

Beyond making money, EUR/USD trading also allows access to a particular lifestyle, where freedom is much greater than in a traditional professional activity. Indeed, what is the point of earning considerable sums if it is at the cost of a job that consumes all your time and energy and keeps you away from your family? EUR/USD trading makes it possible, under many conditions, to reconcile a highly remunerative career and a rich personal life.

However, as much to announce it immediately: There are many candidates, but few elected. Achieving a living from trading is not within everyone’s reach. You have to take the time to train, not to be discouraged by the first failures , and to work tirelessly, often in addition to a traditional professional activity, to perhaps one day become efficient and regular enough to decide to make a living from it, and to make it your only professional activity. However, it is much less difficult to earn a regular extra income trading forex, which can be an ideal first goal before considering making a living from EUR/USD trading.

Conclusion:

Forex trading is definitely an exhilarating activity where you can make a lot of money (at the cost of high risk of losses), and EUR/USD trading is arguably the most popular option . The Euro Dollar currency pair, as the most traded currency pair in the world, indeed has many advantages that we have discussed in this guide.

If you also want to take advantage of it, and start the adventure of EUR/USD trading, and who knows, maybe one day make a living from it, you will need to choose a good forex broker. All of the ones we have covered in this guide are very reliable brokers, which will suit most investors. But there is still one that stands out more than the others : The online broker eToro. Its ideal platform for beginners, the absence of commission and the social trading functions make it an ideal broker for EUR/USD trading.: